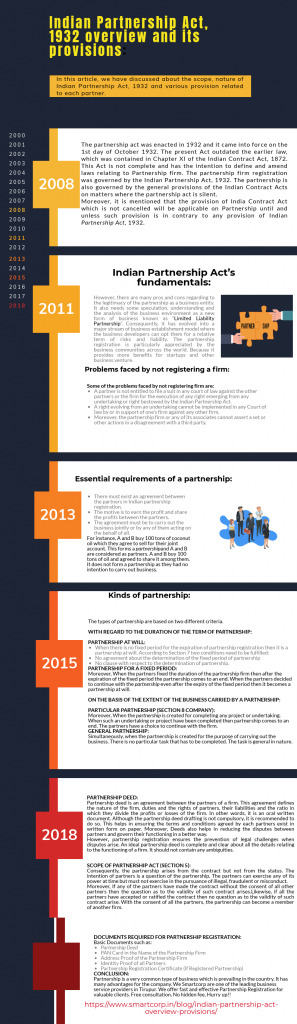

Indian Partnership Act, 1932 overview and its provisions:

In this article, we have discussed about the scope, nature of Indian Partnership Act, 1932 and various provision related to each partner.

The partnership act was enacted in 1932 and it came into force on the 1st day of October 1932. The present Act outdated the earlier law, which was contained in Chapter XI of the Indian Contract Act, 1872. This Act is not complete and has the intention to define and amend laws relating to Partnership firm. The partnership firm registration was governed by the Indian Partnership Act, 1932. The partnership is also governed by the general provisions of the Indian Contract Acts on matters where the partnership act is silent.

Moreover, it is mentioned that the provision of India Contract Act which is not cancelled will be applicable on Partnership until and unless such provision is in contrary to any provision of Indian Partnership Act, 1932. The rules of contract regarding the capacity to contract, offer, acceptance etc. will also be applicable to the partnership. But the rules regarding the status of minor will be governed by the Partnership Act, 1932 since Section 30 of the Act talks about the position of the minor.

Indian Partnership Act’s fundamentals:

However, there are many pros and cons regarding to the legitimacy of the partnership as a business entity. It also needs some speculation, understanding and the analysis of the business environment as a new form of business known as “Limited Liability Partnership”. Consequently, it has evolved into a major stream of business establishment model where the business developers can opt them for a relative term of risks and liability. The partnership registration is particularly appreciated by the business communities across the world. Because it provides more benefits for startups and other business venture.

Problems faced by not registering a firm:

Some of the problems faced by not registering firm are:

- A partner is not entitled to file a suit in any court of law against the other partners or the firm for the execution of any right emerging from any undertaking or right bestowed by the Indian Partnership Act.

- A right evolving from an undertaking cannot be implemented in any Court of law by or in support of one’s firm against any other firm.

- Moreover, the partnership firm or any of its associates cannot assert a set or other actions in a disagreement with a third party.

Nature of Business:

Chiefly,it is a business organization where two or more persons agreed to join together to carry out the business for the purpose of earning the profits. It is an extension of a sole proprietorship.Furthermore, It is better than sole proprietorship because in sole proprietorship the business is carried out by the individual with limited capital and limited skill. Due to the limited resources of a single individual carrying a sole proprietorship, a larger business requiring more resources and investment than available to the sole proprietor cannot be thought of such business. On the other hand in partnership, a number of partners join together with their capital to form an agreement and carry out a business jointly.

Essential requirements of a partnership:

- There must exist an agreement between the partners in Indian partnership registration.

- The motive is to earn the profit and share the profits between the partners.

- The agreement must be to carry out the business jointly or by any of them acting on the behalf of all.

For instance, A and B buy 100 tons of coconut oil which they agree to sell for their joint account. This forms a partnership and A and B are considered as partners. A and B buy 100 tons of oil and agreed to share it among them. It does not form a partnership as they had no intention to carry out business.

Number of members:

In case, if any two or more than two persons can form a partnership firm. There is no limit imposed on the number of partners under the Partnership Act, 1932. According to Companies Act 2013, the maximum number of members should not exceed 100 in case of partnership and minimum is 2 partners. In case, if it exceeds the maximum limit then it will amount to the illegal association under Section 464 of Companies Act, 2013. According to Section 11 of Companies Act the maximum number of partner in case of: Banking purpose-10 persons and other purposes- 20 persons

Kinds of partnership:

The types of partnership are based on two different criteria.

With regard to the duration of the term of partnership:

Partnership at will:

- When there is no fixed period for the expiration of partnership registration then it is a partnership at will. According to Section 7 two conditions need to be fulfilled:

- No agreement about the determination of the fixed period of partnership

- No clause with respect to the determination of partnership.

Partnership for a fixed period:

Moreover, When the partners fixed the duration of the partnership firm then after the expiration of the fixed period the partnership comes to an end. When the partners decided to continue with the partnership even after the expiry of the fixed period then it becomes a partnership at will.

On the basis of the extent of the business carried by a partnership:

Particular Partnership (Section 8 Company):

Moreover, When the partnership is created for completing any project or undertaking. When such an undertaking or project have been completed then partnership comes to an end. The partners have a choice to continue with the firm.

General Partnership:

Simultaneously, when the partnership is created for the purpose of carrying out the business. There is no particular task that has to be completed. The task is general in nature.

Partnership Deed:

Partnership deed is an agreement between the partners of a firm. This agreement defines the nature of the firm, duties and the rights of partners, their liabilities and the ratio in which they divide the profits or losses of the firm. In other words, it is an oral written document. Although the partnership deed drafting is not compulsory, it is recommended to do so. This helps in ensuring the terms and conditions agreed by each partners exist in written form on paper. Moreover, Deeds also helps in reducing the disputes between partners and govern their functioning in a better way.

However, partnership registration ensures the prevention of legal challenges when disputes arise. An ideal partnership deed is complete and clear about all the details relating to the functioning of a firm. It should not contain any ambiguities.

Scope of Partnership Act (Section 5):

Consequently, the partnership arises from the contract but not from the status. The intention of partners is a question of the partnership. The partners can exercise any of its power at time but must not exercise in the pursuance of illegal, fraudulent or misconduct.

Moreover, If any of the partners have made the contract without the consent of all other partners then the question as to the validity of such contract arises.Likewise, if all the partners have accepted or ratified the contract then no question as to the validity of such contract arise. With the consent of all the partners, the partnership can become a member of another firm.

How is registration done?

Section 58 explains the procedure of the registration of a partnership firm.

- Making an application to Registrar: Any of its partners can send an application along with the prescribed fee and copy of partnership deed or the registrar of the area where the business is carried out. Such a statement should be signed by all of its partner and it should contain:

- Name of the firm

- Principal place of business

- Any other place where the business is carried on

- Duration of partnership firm

- Name and address of all partners of a firm

- The date on which each partner joined the firm

- Verification: The partner who signed the deed need to be verified.

- The name of the firm should not contain any name regarding to the name of Crown, Emperor, king, Royal, Emperors’, or any other words expressing the sanction of the government.

In fact, Section 59 states that when the Registrar is satisfied that the conditions of Section 58 are complied with then he can record an entry of the statement in a register called the Register of Firms, and can file the statement.

Documents required for partnership registration:

Basic Documents such as:

- Partnership Deed

- PAN Card in the Name of the Partnership Firm

- Address Proof of the Partnership Firm

- Identity Proof of all Partners

- Partnership Registration Certificate (if Registered Partnership)

Conclusion:

Partnership is a very common type of business which is prevailing in the country. It has many advantages for the company. We Smartcorp are one of the leading business service providers in Tirupur. We offer fast and effective Partnership Registration for valuable clients. Free consultation, No hidden fee, Hurry up!!