GST registration in Bangalore

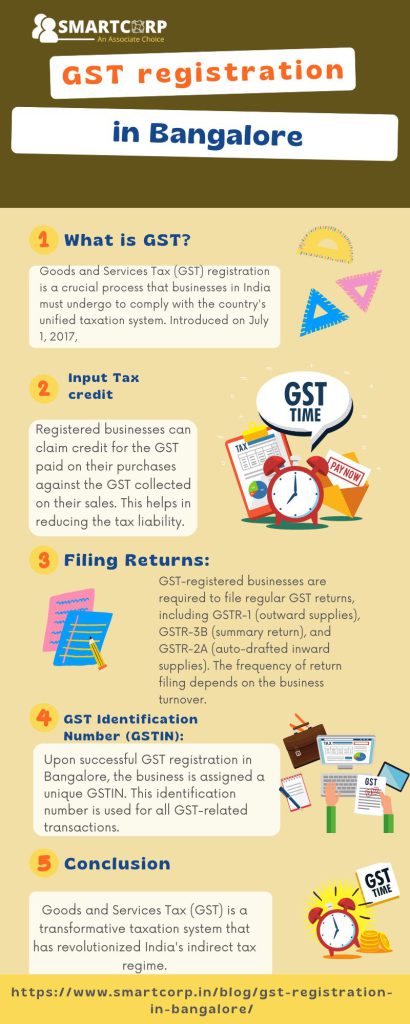

Goods and Services Tax (GST) registration is a crucial process that businesses in India must undergo to comply with the country’s unified taxation system. Introduced on July 1, 2017, GST replaced the complex web of indirect taxes and brought about a standardized tax structure for the supply of goods and services across the nation. Here’s an overview of GST registration in India:

GST registration in Bangalore is mandatory for businesses whose aggregate turnover exceeds a specified threshold.

Threshold Limits:

The threshold for mandatory GST registration in Bangalore is as follows:

For businesses operating in most states, the threshold limit is Rs. 20 lakh (Rs. 10 lakh for special category states).

For certain businesses, like suppliers of goods, the threshold is Rs. 40 lakh (Rs. 20 lakh for special category states).

Voluntary Registration:

Even if a business doesn’t meet the mandatory threshold, it can opt for voluntary GST registration. This can provide benefits such as availing input tax credits, expanding market reach, and improving credibility.

Process of Registration:

Businesses seeking GST registration in Bangalore must apply online through the Goods and Services Tax Network (GSTN) portal.

The applicant needs to provide required documents, including PAN, Aadhaar, bank account details, proof of business location, and other relevant documents.

After submission, the application is verified, and if everything is in order, the GST registration certificate is issued. If there are any discrepancies or additional information is required, the applicant may need to provide further documentation or clarification.

Composition Scheme:

Small businesses with an aggregate turnover below a certain limit can opt for the composition scheme. This scheme allows for simplified compliance and a lower tax rate. However, businesses under the composition scheme cannot avail input tax credits.

Input Tax Credit:

One of the key features of GST registration in Bangalore is the availability of input tax credit. Registered businesses can claim credit for the GST paid on their purchases against the GST collected on their sales. This helps in reducing the tax liability.

Filing Returns:

GST-registered businesses are required to file regular GST returns, including GSTR-1 (outward supplies), GSTR-3B (summary return), and GSTR-2A (auto-drafted inward supplies). The frequency of return filing depends on the business turnover.

Penalties for Non-Compliance:

Failure to obtain GST registration in Bangalore or comply with GST regulations can lead to penalties and legal consequences. It’s important for businesses to adhere to the registration and filing requirements to avoid such issues.

Changes and Updates:

Businesses must keep their GST registration details up to date. Any changes in business structure, ownership, or other relevant information must be promptly reported to the tax authorities.

Multiple Registrations:

If a business operates in multiple states, it may need to obtain separate GST registrations for each state.

GST Identification Number (GSTIN):

Upon successful GST registration in Bangalore, the business is assigned a unique GSTIN. This identification number is used for all GST-related transactions.

What are the 4 types of GST?

Goods and Services Tax (GST) is categorized into four types based on the nature of the transaction and the entities involved. These four types of GST are as follows:

Central Goods and Services Tax (CGST):

CGST is the portion of GST that is collected by the central government on intra-state supplies of goods and services.

It is applicable when both the supplier and the recipient of the goods or services are located within the same state or union territory. The revenue collected through CGST goes to the central government. Any kind of GST can get GST registration in Bangalore.

State Goods and Services Tax (SGST):

SGST is the component of GST collected by the state government on intra-state supplies. Like CGST, it applies to transactions where both the supplier and the recipient are located within the same state or union territory. The revenue of SGST goes to the respective state government.

Integrated Goods and Services Tax (IGST):

IGST is applicable to inter-state supplies of goods and services, meaning when the supplier and the recipient are located in different states or union territories.

IGST is collected by the central government but is then distributed to the respective states or union territories where the goods or services are consumed. It simplifies the process of taxation for inter-state transactions. Any type of GST can get GST registration in Bangalore.

Union Territory Goods and Services Tax (UTGST):

UTGST is similar to SGST but is applicable to the union territories of India. It is collected by the respective union territory governments on intra-union territory supplies.

UTGST is implemented in union territories that do not have their own legislatures to pass their own state GST laws.

It’s important to note that these different types of GST work together to create a seamless and unified tax structure across India.

The combination of CGST, SGST, and IGST ensures that appropriate revenues are collected by both the central and state governments for intra-state and inter-state transactions.

UTGST is relevant for union territories specifically.

The implementation of GST has led to the removal of the earlier complex system of multiple indirect taxes and has streamlined the taxation process, making it more efficient and transparent.

Recent news in GST

GST Council’s Decision on Excessive Taxing for Online Gaming Is Counterintuitive

India saw huge development in online gaming with 15 billion game downloads (the most elevated worldwide), arriving at 50 crore gamers in FY 2021-22 contrasted with 45 crore in FY 2020-21.

As of now, there are around 900 gaming industries in India offering different configurations of online gaming.

The gaming industry’ contribution to the exchequer additionally expanded to Rs 2,000 crore in FY 2020-21 and may twofold by 2025.

In a new GST Council meeting, it was chosen to end the qualification between expertise based gaming, like online gaming, and chance-based gaming like gambling clubs.

The GST rate on internet gaming administrators was raised from 18% on Gross Gaming Revenue (GGR) or platform fee to 28 percent on Contest Entry Amount (CEA), which is the full worth of wagers put.

This expansion in taxation rate makes a double issue of seaward and unlawful gaming.

The adjustment of tax collection could vigorously influence the ventures the area has gotten up to this point and expected future speculations, making the online gaming business less worthwhile.

This might prompt less stages entering the area, seriously affecting advancement.

Furthermore, it will deter players from getting to authentic gaming stages that keep the law and make good on charges, prompting the expansion of offshore and unlawful gaming stages and reducing revenue generation for the exchequer.

Conclusion

In conclusion, Goods and Services Tax (GST) is a transformative taxation system that has revolutionized India’s indirect tax regime. Introduced on July 1, 2017, GST replaced a convoluted network of multiple taxes with a unified framework, streamlining the tax structure and fostering economic growth.